Before you sign that loan agreement, use our loan repayment calculator to know exactly what you’ll pay every month. Most Kenyans discover they’ll pay 20-50% more than expected once they calculate properly.

Your colleague just got a personal loan at “only 15% interest.” Sounds cheap, right? But when you calculate it properly, that KSh 100,000 loan costs KSh 127,856 over 24 months. That’s KSh 27,856 in interest they didn’t expect.

Use our Net Pay Calculator to see your take-home salary, then use this loan repayment calculator to ensure payments fit your budget.

Why You Need This Loan Repayment Calculator Before Applying #

With Kenya’s average bank lending rates around 15-18% according to Central Bank of Kenya data, knowing your exact monthly payments helps you:

- Budget accurately for monthly repayments without surprises

- Compare different loan offers properly (EMI vs reducing balance vs flat rate)

- Avoid borrowing more than you can afford to repay

- Negotiate better terms with your bank using real numbers

- Plan early repayment to save thousands in interest

How to Use This Loan Repayment Calculator #

Step 1: Enter the loan amount you want to borrow (KSh 10,000 to KSh 5,000,000)

Step 2: Input the annual interest rate your lender quoted (check CBK rates for benchmarks)

Step 3: Select the loan term – how many months you’ll repay (6 to 60 months)

Step 4: Choose calculation method:

- EMI (Fixed Payment) – Same amount every month

- Reducing Balance – Payments decrease over time

- Flat Rate – Highest cost, avoid if possible

Step 5: Click “Calculate” to see:

- Monthly payment amount

- Total amount you’ll pay back

- Total interest cost

- Complete payment breakdown

Compare your results with specific bank calculators:

Understanding Loan Types in Kenya #

Before using our loan repayment calculator, know which type you’re considering:

Bank Personal Loans #

Interest rates: 12.6% to 18% annually (unsecured loans)

Loan amounts: KSh 50,000 to KSh 3 million

Repayment period: 6 months to 5 years

Best for: Large amounts, longer repayment periods

Check current rates at:

Sacco Loans #

Interest rates: 12% to 15% annually (usually cheapest)

Requirements: Membership and savings

Repayment period: Flexible, up to 5 years

Best for: Members wanting lowest rates

Find a Sacco via Kenya Union of Savings & Credit Co-operatives (KUSCCO).

Digital App Loans #

Interest rates: 15-20% monthly (180-240% annually!)

Loan amounts: KSh 1,000 to KSh 300,000

Repayment period: 30 to 180 days

Best for: Emergencies only, very short-term

Compare with our Hustler Fund Calculator for cheaper government alternative.

Asset-Backed Loans (Logbook, Title Deed) #

Interest rates: 8% to 15% annually (lower due to collateral)

Loan amounts: Higher limits based on asset value

Risk: You can lose your asset if you default

Best for: Large loans at lower rates

Understanding Interest Rate Calculation Methods #

Kenya has three main ways banks calculate loan interest. Our loan repayment calculator handles all methods:

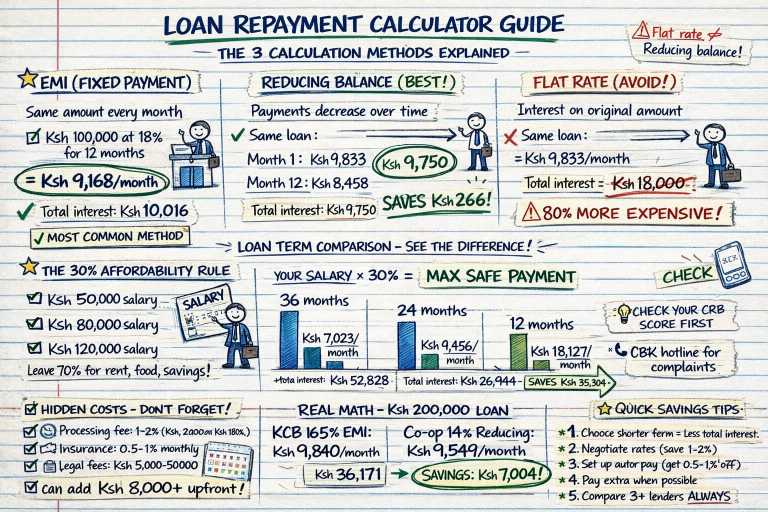

1. EMI Method (Fixed Monthly Payment) – Most Common #

Same payment every month. Interest and principal portions change.

Example: KSh 100,000 at 18% for 12 months

- Fixed monthly payment: KSh 9,168

- Total repayment: KSh 110,016

- Total interest: KSh 10,016

Formula: EMI = [P × R × (1+R)^N] / [(1+R)^N – 1]

Where P = Principal, R = Monthly interest rate, N = Number of months

2. Reducing Balance Method #

Interest calculated on remaining balance each month. Payments decrease over time.

Example: KSh 100,000 at 18% for 12 months

- First month: KSh 9,833 (KSh 8,333 principal + KSh 1,500 interest)

- Last month: KSh 8,458 (KSh 8,333 principal + KSh 125 interest)

- Average payment: KSh 9,146

- Total interest: KSh 9,750

Savings: KSh 266 cheaper than EMI method!

3. Flat Rate Method – AVOID THIS #

Interest calculated on original loan amount throughout entire term. Most expensive.

Example: KSh 100,000 at 18% flat for 12 months

- Monthly payment: KSh 9,833

- Total interest: KSh 18,000

- 80% more expensive than reducing balance!

Important: Banks must provide Total Cost of Credit breakdown per Central Bank of Kenya regulations. Always ask which method they use.

Real Loan Comparison: KSh 200,000 for 24 Months #

Use our loan repayment calculator to compare these actual scenarios:

Option A: KCB Personal Loan (EMI Method) #

- Interest rate: 16.5%

- Fixed monthly payment: KSh 9,840

- Total repayment: KSh 236,171

- Total interest: KSh 36,171

Option B: Equity Bank Loan (EMI Method) #

- Interest rate: 17.2%

- Fixed monthly payment: KSh 9,908

- Total repayment: KSh 237,784

- Total interest: KSh 37,784

Option C: Co-op Bank (Reducing Balance) #

- Interest rate: 14%

- First payment: KSh 10,667 (decreasing)

- Average payment: KSh 9,549

- Total repayment: KSh 229,167

- Total interest: KSh 29,167

Winner: Co-op Bank saves you KSh 7,004 vs KCB and KSh 8,617 vs Equity.

That’s enough to cover NSSF contributions for 7 months or invest in a money market fund earning 16%!

How Much Can You Actually Afford? – The 30% Rule #

Financial experts recommend total loan payments shouldn’t exceed 30% of monthly income.

Affordability Formula: Monthly Income × 0.30 = Maximum Safe Loan Payment

Real Examples Using Our Loan Repayment Calculator #

If you earn KSh 50,000/month:

- Maximum safe payment: KSh 15,000

- You can afford: ~KSh 306,000 loan at 16% for 24 months

- Monthly payment: KSh 15,000

- Total interest: KSh 53,856

If you earn KSh 80,000/month:

- Maximum safe payment: KSh 24,000

- You can afford: ~KSh 490,000 loan at 16% for 24 months

- Monthly payment: KSh 24,000

- Total interest: KSh 86,170

If you earn KSh 120,000/month:

- Maximum safe payment: KSh 36,000

- You can afford: ~KSh 735,000 loan at 16% for 24 months

- Monthly payment: KSh 36,000

- Total interest: KSh 129,255

Use our Net Pay Calculator to calculate your actual take-home after PAYE, NSSF, and SHIF deductions.

Save Thousands with Smart Loan Strategies #

Strategy 1: Choose Shorter Terms When Possible #

Same KSh 200,000 loan at 16% EMI:

| Term | Monthly Payment | Total Interest | You Save |

|---|---|---|---|

| 36 months | KSh 7,023 | KSh 52,828 | – |

| 24 months | KSh 9,456 | KSh 26,944 | KSh 25,884 |

| 12 months | KSh 18,127 | KSh 17,524 | KSh 35,304 |

If you can afford KSh 18,127/month instead of KSh 7,023, you save KSh 35,304!

Strategy 2: Compare Payment Methods #

Same KSh 200,000 at 16% for 24 months:

- EMI: KSh 9,456/month, total interest KSh 26,944

- Reducing Balance: Average KSh 9,245/month, total interest KSh 21,880

- Flat Rate: KSh 10,667/month, total interest KSh 56,000

Reducing balance saves KSh 5,064 vs EMI, KSh 34,056 vs flat rate!

Strategy 3: Make Extra Payments #

Adding just KSh 1,000 to your monthly payment:

Example: KSh 300,000 at 18% for 36 months

- Standard payment: KSh 10,845/month

- With extra KSh 1,000: KSh 11,845/month

- Loan paid off in: 31 months (5 months early!)

- Interest saved: KSh 8,750

Use the loan repayment calculator to model different extra payment amounts.

Strategy 4: Negotiate Interest Rates #

If you have:

- Good credit score (check at Metropol CRB or TransUnion Kenya)

- Existing relationship with the bank

- Additional security/collateral

You can negotiate 1-3% lower rates.

Impact on KSh 500,000 for 36 months:

- At 18%: KSh 18,068/month, total interest KSh 150,448

- At 15%: KSh 17,320/month, total interest KSh 123,520

- Savings: KSh 26,928 from 3% reduction!

Common Loan Calculator Mistakes to Avoid #

Mistake 1: Confusing Flat Rate with Reducing Balance #

A 15% flat rate actually costs about 28% in reducing balance terms!

Always confirm which method your lender uses. Our loan repayment calculator clearly shows both calculations.

Mistake 2: Ignoring Processing Fees #

Factor in all costs beyond interest:

- Processing fees (1-2% of loan amount)

- Insurance premiums (0.5-1% monthly)

- Legal fees for secured loans (KSh 5,000-50,000)

- Early settlement penalties (check terms)

Example: KSh 100,000 loan

- Processing fee (2%): KSh 2,000

- Insurance (12 months): KSh 6,000

- Total upfront cost: KSh 8,000

You only receive KSh 92,000 but repay based on KSh 100,000!

Mistake 3: Borrowing the Maximum Approved Amount #

Just because you qualify for KSh 500,000 doesn’t mean you should borrow it all.

KSh 500,000 at 18% for 36 months:

- Monthly payment: KSh 18,068

- Total repayment: KSh 650,448

- Total interest: KSh 150,448

Ask yourself: Do I actually need KSh 500,000, or will KSh 300,000 do?

KSh 300,000 at same terms:

- Monthly payment: KSh 10,841

- Total repayment: KSh 390,269

- You save: KSh 260,179!

Mistake 4: Not Reading the Fine Print #

Some loans have:

- Variable interest rates that can increase (linked to CBK base rate)

- Balloon payments at the end

- Prepayment penalties if you clear early

- Compulsory insurance you may not need

Banks must provide a Total Cost of Credit statement showing all fees. Request this before signing.

Your Loan Repayment Strategy #

1. Set Up Automatic Payments #

Most banks offer 0.5-1% interest discount for automatic deductions from salary account.

Benefit on KSh 200,000 loan at 16% for 24 months:

- Without discount: Total interest KSh 36,944

- With 1% discount (15%): Total interest KSh 33,528

- Savings: KSh 3,416

2. Create a Loan Emergency Fund #

Save at least 3 months of loan payments for:

- Job loss situations

- Medical emergencies

- Income reduction

Example: If your loan payment is KSh 10,000/month, keep KSh 30,000 in a money market fund earning interest while available for emergencies.

3. Plan for Early Settlement #

If you get a bonus or salary increase, calculate savings from early repayment:

KSh 400,000 loan at 17% for 36 months:

- Standard total cost: KSh 524,179

- Pay off after 18 months: Total cost KSh 470,234

- Savings: KSh 53,945

Use the loan repayment calculator to see exact savings for your loan.

4. Refinance When Rates Drop #

If CBK rates drop or your credit score improves:

Original loan: KSh 300,000 at 18% for 36 months (KSh 10,845/month)

After 12 months, refinance at 14%: Save KSh 1,200+ monthly on remaining balance

When to Use Each Loan Type #

Use Bank Personal Loans When: #

- You need large amounts (over KSh 100,000)

- You want longer repayment terms (2-5 years)

- You have steady employment and good credit

- You can get competitive rates (under 18%)

- You need structured repayment schedule

Use Sacco Loans When: #

- You’re already a member with savings

- You want the lowest interest rates (12-15%)

- You can wait for approval (1-2 weeks)

- You need flexible repayment terms

- You want dividend benefits on shares

Find your Sacco via KUSCCO directory.

Use Government Hustler Fund When: #

- You need KSh 500 to KSh 50,000

- You can repay within 14 days

- You want 8% annual interest (cheapest short-term)

- You need money instantly

Use our Hustler Fund Calculator to compare costs.

Avoid Loans When: #

- Monthly payment exceeds 30% of income

- You have no emergency fund

- Interest rate is above 25%

- You’re borrowing to repay other loans

- The loan isn’t for an income-generating purpose or essential need

Start Calculating Your Loan Repayments Now #

Scroll up and use our comprehensive loan repayment calculator before you apply for any loan.

Quick calculation checklist:

- Enter exact loan amount you need (not maximum approved)

- Input the interest rate and confirm calculation method

- Try different loan terms to see monthly payment impact

- Ensure monthly payment is under 30% of your income

- Add processing fees to get true cost

- Compare at least 3 different lenders

Related Calculators:

- Net Pay Calculator – See your actual take-home

- Hustler Fund Calculator – Compare government loans

- M-Pesa Transaction Calculator – Track mobile money costs

- PAYE Calculator – Calculate income tax

- Compound Interest Calculator – See investment growth potential

External Resources:

- Central Bank of Kenya Rates – Current benchmark rates

- CBK Licensed Banks – Verified lenders

- Metropol CRB – Check your credit score

- TransUnion Kenya – Credit reports

- KUSCCO – Find a Sacco

- Financial Sector Deepening Kenya – Financial literacy resources

Disclaimer: Loan repayment calculator provides estimates based on inputs. Actual loan costs may vary based on lender terms, fees, and calculation methods. Interest rates change regularly – verify current rates with lenders. Always request Total Cost of Credit statement before signing any loan agreement as required by Central Bank of Kenya.

Pro tip: The cheapest monthly payment isn’t always the best deal. A KSh 7,000/month loan over 60 months costs more in total interest than KSh 15,000/month over 24 months. Use our loan repayment calculator to compare total costs, not just monthly payments. Most Kenyans save 20-40% on interest by choosing shorter terms and negotiating rates.

Comments