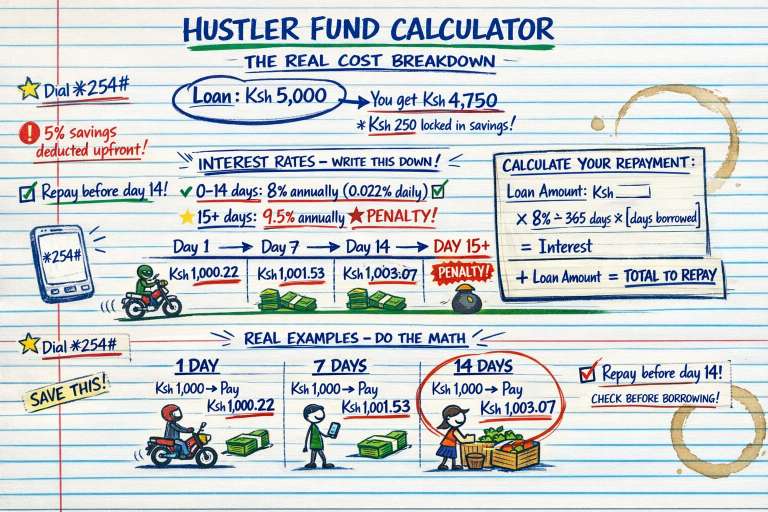

Before you dial *254# to borrow, this Hustler Fund calculator shows exactly what you’ll pay back. Most people forget about the 5% savings deduction and end up short on cash. Use this calculator to avoid that mistake and plan smart.

Use our Net Pay Calculator to see your actual take-home, then plan your Hustler Fund repayments around your salary.

Why You Need This Hustler Fund Loan Calculator #

- See exact repayment amount including the 8% interest (9.5% if late)

- Account for 5% savings deduction – borrow KSh 1,000, get KSh 950

- Compare payment dates to find cheapest option

- Track 14-day deadline to avoid penalty rates

- Plan early repayment to save on interest

How to Use This Hustler Fund Loan Calculator #

- Enter loan amount – How much you want to borrow (KSh 50 to KSh 50,000)

- Select loan date – When you received or will receive the money

- Choose payment date – When you plan to repay (leave empty for today)

- See results – Total repayment, interest cost, and money you actually get

Quick Start: How to Get Hustler Fund #

*Dial 254# from your Safaricom line:

- Select “Hustler Fund”

- Accept terms and conditions

- Get instant KSh 500 starting limit

- Borrow immediately

Requirements:

- Kenyan ID

- Safaricom line in your name

- Active M-Pesa

- 18+ years old

Total time: Under 5 minutes.

For detailed setup instructions, visit Government of Kenya’s official Hustler Fund portal.

How Hustler Fund Loan Works (2026 Rates) #

Interest Rates:

- 8% annually for first 14 days (0.022% daily)

- 9.5% annually after 14 days if overdue

- KSh 1,000 for 7 days = KSh 1.53 interest

- KSh 1,000 for 14 days = KSh 3.07 interest

The 5% Savings Rule:

- 5% of every loan goes to savings automatically

- Borrow KSh 1,000 = get KSh 950, save KSh 50

- You still repay KSh 1,000 + interest

- Savings locked, earns interest

Use the Hustler Fund calculator to see real cash after this deduction.

Repayment Terms:

- Standard period: 14 days

- After 14 days: Interest increases to 9.5% annually

- Affects your credit score if you miss deadline

- Repay early to save on interest

Check Government of Kenya’s official Hustler Fund portal for the latest program updates and terms.

Real Hustler Fund Loan Scenarios – Calculator Examples #

Scenario 1: Boda Rider Daily Fuel (Pay in 1 Day) #

Using the calculator:

- Loan amount: KSh 1,000

- Loan date: Monday

- Payment date: Tuesday (1 day)

Results:

- You receive: KSh 950 (after 5% savings)

- Interest for 1 day: KSh 0.22

- Total repayment: KSh 1,000.22

- Real cost: KSh 0.22

Worth it? You earn KSh 2,000 daily from fares. Pay KSh 0.22 for access to fuel money.

Scenario 2: Mama Mboga Weekly Stock (Pay in 7 Days) #

Using the calculator:

- Loan amount: KSh 5,000

- Loan date: Monday

- Payment date: Next Monday (7 days)

Results:

- You receive: KSh 4,750 (after 5% savings)

- Interest for 7 days: KSh 7.67

- Total repayment: KSh 5,007.67

- Savings deducted: KSh 250

Business math: Buy stock for KSh 4,750, sell at 40% markup = KSh 6,650 revenue. Repay KSh 5,007.67, keep KSh 1,642+ profit.

Scenario 3: Salary Worker Emergency (Pay in 14 Days) #

Using the calculator:

- Loan amount: KSh 10,000

- Loan date: Day 20 of month

- Payment date: Day 1 next month (14 days)

Results:

- You receive: KSh 9,500 (after 5% savings)

- Interest for 14 days: KSh 30.68

- Total repayment: KSh 10,030.68

- Savings locked: KSh 500

Comparison with other mobile loans:

| Loan Source | You Get | Fees/Interest | Total Repay (14 days) |

|---|---|---|---|

| Hustler Fund | KSh 9,500 | KSh 31 | KSh 10,031 |

| M-Shwari | KSh 9,850 | KSh 900 (9% fee) | KSh 10,900 |

| Fuliza | KSh 10,000 | KSh 268 (access + daily) | KSh 10,268 |

| Branch/Tala | KSh 10,000 | KSh 1,500+ | KSh 11,500+ |

Cost breakdown:

- Hustler Fund: Cheapest at KSh 31 for 14 days

- Fuliza: KSh 100 access + (KSh 12/day × 14) = KSh 268 total

- M-Shwari: KSh 900 facilitation fee (30-day loan, can’t repay in 14 days)

Best choice: Hustler Fund saves KSh 237-1,469 compared to alternatives for 14-day borrowing.

Use our M-Shwari Calculator and Fuliza Calculator to compare exact costs for your amount.

Scenario 4: Late Payment (20 Days – Overdue) #

Using the calculator:

- Loan amount: KSh 5,000

- Loan date: January 1

- Payment date: January 21 (20 days – 6 days late)

Results:

- You received: KSh 4,750

- Interest breakdown:

- First 14 days at 8% = KSh 15.34

- Next 6 days at 9.5% = KSh 7.81

- Total interest: KSh 23.15

- Total repayment: KSh 5,023.15

- Extra cost for being late: KSh 7.81

Warning: Late payment damages credit score and affects future limits. Use the calculator to see exact penalty before you’re late.

How to Pay Hustler Fund #

*Method 1 – Via 254# (Fastest):

- Dial *254#

- Select “Repay Loan”

- Enter amount

- Confirm with M-Pesa PIN

Method 2 – M-Pesa Paybill:

- Lipa na M-Pesa → Pay Bill

- Business number: [Hustler Fund paybill]

- Account: Your phone number

- Amount: What you owe

Method 3 – Auto-deduct:

- Enable in settings via *254#

- Money deducted automatically on due date

Growing Your Credit Limit #

How limits increase:

- Start: KSh 500

- Borrow and repay on time = limit grows

- Growth depends on repayment history

- Maximum varies by user

Using the calculator for limit growth:

- Borrow small amounts first

- Use 7-day repayment to minimize interest

- Repay 1-2 days early to show responsibility

- Check new limit after each successful repayment

Example: Growing from KSh 500 to KSh 10,000

Month 1:

- Borrow KSh 500, repay in 3 days (interest: KSh 0.33)

- Limit may increase to KSh 1,000+

Month 2:

- Borrow KSh 1,000, repay in 7 days (interest: KSh 1.53)

- Limit may increase to KSh 2,500+

Month 3-4:

- Continue pattern with on-time repayments

- Reach KSh 10,000+ in 3-4 months

Use the Hustler Fund calculator to plan each loan amount and repayment date.

Common Mistakes – Avoid These #

Mistake 1: Forgetting 5% Savings #

Need KSh 2,000 cash? Don’t borrow KSh 2,000 (you’ll only get KSh 1,900).

Solution: Borrow KSh 2,106 to get KSh 2,000 after savings (KSh 2,106 – 5% = KSh 2,000). Use the calculator to work backwards.

Mistake 2: Missing the 14-Day Deadline #

After 14 days, interest jumps from 8% to 9.5% annually.

Cost example via calculator:

- KSh 10,000 for 14 days: KSh 30.68 interest

- KSh 10,000 for 28 days: KSh 67.40 interest

- Extra cost for being late: KSh 36.72

Solution: Set phone reminders for 2 days before deadline. Use calculator to see exact due date.

Mistake 3: Not Comparing Payment Dates #

Paying in 7 days vs 14 days costs half the interest.

Example using calculator:

- KSh 5,000 for 7 days: KSh 7.67 interest

- KSh 5,000 for 14 days: KSh 15.34 interest

- Savings by paying early: KSh 7.67

Solution: If you can afford to repay earlier, do it. Check the calculator for different payment dates.

Hustler Fund vs M-Shwari vs Fuliza: Complete Cost Comparison #

Use the Hustler Fund calculator alongside M-Shwari Calculator and Fuliza to see which loan costs less.

How Each Mobile Loan Works #

*Hustler Fund (via 254#):

- Interest: 8% annually (0-14 days), 9.5% after 14 days

- Savings: 5% deducted upfront

- Term: 14 days standard, penalty after

- Access: Instant via *254#

M-Shwari (via M-Pesa):

- Facilitation fee: 9% of loan amount

- Excise duty: 1.5% deducted upfront

- Term: 30 days fixed

- Early repayment: 20% fee refund within 10 days

- Access: Via M-Pesa menu

Fuliza (M-Pesa Overdraft):

- Access fee: 1% charged once

- Daily maintenance: KSh 6-30/day based on amount

- Term: Flexible, pay anytime

- Access: Automatic M-Pesa overdraft

Real Cost Comparison: KSh 5,000 Loan #

Hustler Fund (7 days):

- Amount received: KSh 4,750 (after 5% savings)

- Interest: KSh 7.67

- Total repayment: KSh 5,007.67

- Savings locked: KSh 250

- Net cost: KSh 7.67 (savings return later)

Hustler Fund (14 days):

- Amount received: KSh 4,750

- Interest: KSh 15.34

- Total repayment: KSh 5,015.34

- Net cost: KSh 15.34

M-Shwari (30 days):

- Amount received: KSh 4,925 (after 1.5% excise duty = KSh 75)

- Facilitation fee: KSh 375

- Excise duty: KSh 75 (already deducted)

- Total repayment: KSh 5,375

- Total cost: KSh 450

Learn more about M-Shwari loan terms on Safaricom.

M-Shwari Early (10 days):

- Total repayment: KSh 5,300 (20% refund = KSh 75)

- Total cost: KSh 375

Fuliza (7 days):

- Amount received: KSh 5,000 (full amount)

- Access fee: KSh 50 (1%)

- Daily fee: KSh 12/day × 7 = KSh 84

- Total repayment: KSh 5,134

- Total cost: KSh 134

Fuliza (14 days):

- Access fee: KSh 50

- Daily fee: KSh 12/day × 14 = KSh 168

- Total repayment: KSh 5,218

- Total cost: KSh 218

Check Fuliza rates and terms on Safaricom.

Winner by Duration #

| Timeline | Cheapest Option | Cost | Runner-Up | Cost Difference |

|---|---|---|---|---|

| 1-3 days | Hustler Fund | KSh 1-5 | Fuliza | +KSh 50-80 |

| 7 days | Hustler Fund | KSh 7.67 | Fuliza | +KSh 126 |

| 10 days | Hustler Fund | KSh 11 | Fuliza | +KSh 157 |

| 14 days | Hustler Fund | KSh 15 | Fuliza | +KSh 203 |

| 30 days | Fuliza | KSh 410 | M-Shwari | +KSh 40 |

Key insight: Hustler Fund is cheapest for 1-14 days. For longer than 14 days, Hustler Fund becomes expensive (9.5% rate kicks in).

Real Cost Comparison: KSh 10,000 Loan #

Hustler Fund (14 days):

- You get: KSh 9,500

- Interest: KSh 30.68

- Total repay: KSh 10,030.68

- Cost: KSh 30.68

M-Shwari (30 days):

- You get: KSh 9,850

- Facilitation fee: KSh 750

- Excise duty: KSh 150 (deducted)

- Total repay: KSh 10,750

- Cost: KSh 900

Fuliza (14 days):

- You get: KSh 10,000

- Access fee: KSh 100

- Daily fee: KSh 24/day × 14 = KSh 336

- Total repay: KSh 10,436

- Cost: KSh 436

Hustler Fund saves:

- KSh 869 vs M-Shwari

- KSh 405 vs Fuliza

Use our calculators to compare costs for your specific amount and timeline.

When to Use Each Loan #

Use Hustler Fund if:

- Need money for 1-14 days

- Want lowest interest cost

- Can repay within 2 weeks

- Building credit limit (KSh 500 → KSh 50,000)

- First-time borrower

Use Fuliza if:

- Need full amount (no savings deduction)

- Need money for 15-30 days

- Making M-Pesa payments (direct overdraft)

- Already have good Fuliza limit

Use M-Shwari if:

- Need 30 days to repay

- Can repay within 10 days (get 20% refund)

- Hustler Fund limit is too low

- Already have high M-Shwari limit

Avoid all mobile loans if:

- You have an emergency fund

- Can borrow from family/chama interest-free

- Have time for Sacco loan (12% annually)

Better long-term alternatives:

- Join a Sacco for cheaper loans – Find one via Kenya Union of Savings & Credit Co-operatives

- Start a chama savings group

- Build emergency fund in money market funds

Combined Mobile Loan Costs: Monthly Reality Check #

Typical scenario – someone using all three:

Week 1:

- Hustler Fund KSh 2,000 (7 days): Cost KSh 3.07

- Send via M-Pesa: Transaction charges KSh 33

Week 2:

- Repay Hustler Fund: KSh 2,003.07

- M-Shwari KSh 5,000 (need more): Cost KSh 450

- M-Pesa withdrawal: Transaction charges KSh 77

Week 3:

- Fuliza KSh 1,500 (overdraft for 10 days): Cost KSh 135

Week 4:

- Repay M-Shwari: KSh 5,375

- Clear Fuliza: KSh 1,635

Monthly total:

- Mobile loan costs: KSh 588.07

- M-Pesa transaction charges: KSh 110

- Combined: KSh 698.07

Annual cost: KSh 8,377

This cycle affects your credit score. Check your CRB status at Metropol CRB or TransUnion Kenya.

Use our Net Pay Calculator to see what percentage of your salary goes to mobile money costs.

The Emergency Fund Alternative #

Instead of monthly mobile loans costing KSh 588:

Month 1-3: Save KSh 600/month in money market fund earning 16% Month 4: Emergency fund = KSh 1,850+ (includes interest) Month 6: Emergency fund = KSh 3,750+ Month 12: Emergency fund = KSh 7,850+

Result: Zero mobile loan costs + growing savings vs KSh 8,377 spent on loan fees.

Learn about high-return savings options:

- Sanlam Money Market Fund – Up to 16% p.a.

- CIC Money Market Fund – Competitive rates

- Britam Money Market Fund – Low minimum entry

Compare rates on Capital Markets Authority approved funds.

Use our Money Market Fund Returns Calculator to see how fast your emergency fund grows.

Understanding the Effective Cost #

The calculator shows daily interest, but here’s what it means annually:

Effective Annual Rate (EAR) examples:

- 14-day loan: ~160-180% EAR (includes 5% savings lock + interest)

- 7-day loan: ~200-220% EAR

- 1-day loan: ~300%+ EAR

Why it’s still worth it:

- Most alternatives cost more (Fuliza, loan apps, shylocks)

- Interest is very low in shilling terms (KSh 1.53 for KSh 1,000 weekly)

- 5% savings comes back to you later with interest

- No fees, no hidden charges

The high EAR reflects the very short loan period, not predatory pricing.

Tips to Save Money on Hustler Fund #

1. Pay within 7 days Use the calculator to see exact savings. KSh 10,000 for 7 days = KSh 15.34 interest vs KSh 30.68 for 14 days. Save KSh 15.34.

2. Borrow exact amount needed Don’t borrow KSh 5,000 if you need KSh 3,000. Remember the 5% savings deduction when calculating.

3. Check calculator before every loan Know exact repayment amount before dialing *254#. No surprises.

4. Set reminders for payment Don’t let it go past 14 days. After day 14, you pay 9.5% instead of 8%.

5. Partial payments count Can’t pay everything? Pay what you can. Reduces interest accumulation. The calculator shows interest is charged daily.

FAQ: Hustler Fund Quick Answers #

Q: What’s the USSD code? A: Dial *254# from Safaricom line

Q: How much can I borrow? A: KSh 50 minimum, maximum depends on your limit (starts at KSh 500)

Q: How long do I have to repay? A: 14 days standard. After that, penalty rate of 9.5% applies.

Q: What’s the 5% savings? A: Deducted from your loan upfront. You get it back later with interest. Not a fee.

Q: Can I repay early? A: Yes. Saves on interest. Use calculator to see savings.

Q: What if I’m late? A: Interest increases to 9.5% annually after day 14. Affects credit score.

Q: How do I grow my limit? A: Borrow and repay on time. Limit increases with good repayment history.

Start Using the Hustler Fund Calculator Now #

Scroll up, enter your loan details, and see exactly what you’ll pay before you dial *254#.

Quick wins:

- Check calculator before every loan

- Factor in the 5% savings when calculating how much to borrow

- Choose payment date carefully – earlier = cheaper

- Never go past 14 days to avoid 9.5% rate

- Set phone reminder 2 days before due date

Related Tools:

- Net Pay Calculator – Plan salary vs loan repayment

- M-Pesa Transaction Calculator – Track mobile money costs

- Compound Interest Calculator – See savings growth

- PAYE Calculator – Understand salary deductions

External Resources:

- Government Hustler Fund Portal – Program information

- Central Bank of Kenya – Financial consumer protection

- Metropol CRB – Check your credit score

- Kenya Union of Savings & Credit Co-operatives – Find a Sacco

- Capital Markets Authority – Licensed investment funds

Learn How to Reduce Transaction Costs across all platforms including Hustler Fund.

Disclaimer: Hustler Fund rates based on January 2026 government terms. Rates: 8% p.a. (0-14 days), 9.5% p.a. (15+ days overdue). Always verify current rates via *254# before borrowing. This calculator provides estimates for planning purposes only.

For official government information, visit hustlerfund.go.ke.

Pro tip: Treat Hustler Fund like business capital, not free money. That KSh 1,000 should generate more than the KSh 1.53 weekly interest it costs. If your investment won’t beat the cost, don’t borrow. Instead, build an emergency fund in a licensed money market fund earning 15-16% annually.

Comments