Your M-Pesa account holds months of transaction history. Bills paid, money sent, airtime bought—it’s all there. But most people don’t know how to access this information when they need it.

Maybe you’re applying for a loan and the bank wants proof of income. Or you’re trying to remember when you paid rent last month. Or you just want to see where your money goes each week.

Getting your M-Pesa statement is easier than you think. You can do it from your phone in under two minutes. No need to visit a Safaricom shop or wait in line.

What Is an M-Pesa Statement?

An M-Pesa statement is a record of all your M-Pesa transactions over a specific time period. It shows:

- Money you sent

- Money you received

- Bill payments

- Airtime purchases

- Withdrawals from agents

- Deposits to your account

Think of it as your mobile money bank statement. The difference? You can get it instantly, right from your phone.

There are two types of statements you can request:

Mini statement – Shows your last 5 transactions. Good for quick checks.

Full statement – Shows all transactions for up to 12 months. Comes as a PDF with an official stamp from Safaricom.

Why You Need Your M-Pesa Statement

Most people only think about their statement when someone asks for it. But checking it regularly helps you:

- Track your spending patterns and see where money goes

- Catch any fraudulent transactions before they pile up. If you spot unauthorized transactions, report them immediately to Safaricom’s M-Pesa customer care or visit your nearest Safaricom shop.

- Have proof of payment when someone claims you didn’t pay

- Apply for loans—many lenders now accept M-Pesa statements as proof of income

- File your taxes if you run a small business

- Settle payment disputes with proof from an official document

How to Download Your M-Pesa Statement (4 Methods)

Method 1: Using USSD Code (Fastest Way)

This is the quickest method. Dial *334# from your M-Pesa registered line, select option 7 for “My Account,” then choose option 3 for “M-Pesa Statement.”

Pick the type of statement you want:

- Full statement (recommended for most uses)

- Mini statement (just last 5 transactions)

Select your time period:

- 1 month

- 3 months

- 6 months

- 12 months

Enter your email address. Make sure you type it correctly. The statement will arrive in your inbox within minutes.

Check your spam folder if you don’t see it right away. Sometimes email providers filter these messages.

Method 2: M-Pesa App

Download the M-Pesa app from Google Play Store or Apple App Store. Open the app and log in with your phone number. Look for the “Statement” section in the menu. Choose your date range and download the digitally stamped statement instantly or have it sent to your email.

The app method gives you a stamped PDF. Banks and loan companies accept this as an official document.

Method 3: Safaricom Self-Care Portal

Visit the Safaricom Self-Care web portal on your browser, sign up or log in with your Safaricom line, go to the M-Pesa Statement section, and choose your time period up to 12 months.

This works well if you’re already on your computer and need the statement for an online application.

Method 4: Visit a Safaricom Shop

Sometimes you need an official statement for court or legal matters. Visit the nearest Safaricom shop and tell them you need an M-Pesa statement for court purposes. If it’s for a civil matter, fill in the civil disputes statement request form indicating the purpose of use.

This takes longer but gives you an officially stamped hard copy that’s accepted in legal proceedings.

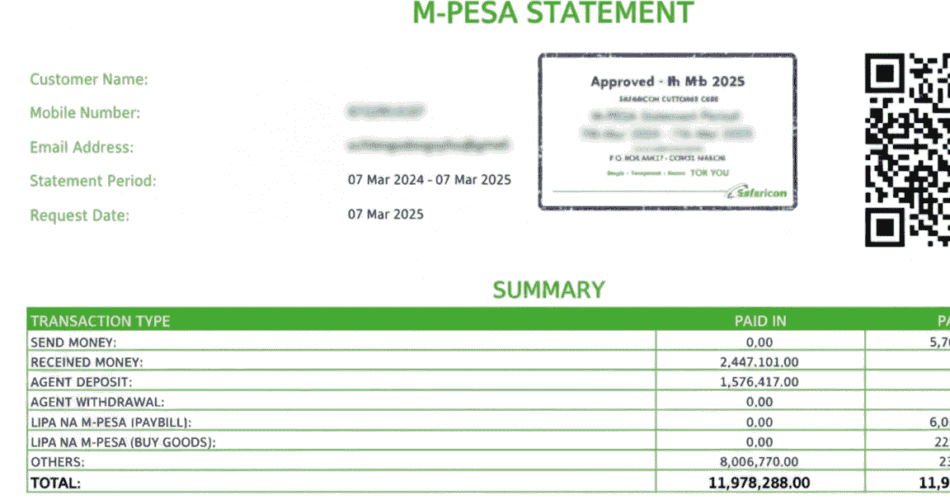

How to Read Your M-Pesa Statement

Your statement comes as a PDF with several columns. Here’s what each one means:

Date and Time – When the transaction happened

Transaction Type – What you did (send money, pay bill, buy airtime)

Details – Who you sent to or received from

Amount – How much moved

Balance – What was left in your account after

Look for patterns. Are you spending more on airtime than you thought? Do certain merchants charge you more than expected? If you’re constantly running low on M-Pesa and relying on Fuliza overdrafts, your statement will show you exactly where your money disappears each month.

The balance column helps you see how your money flows through the month. If it keeps dropping to zero, you might need to adjust your budget.

Common Problems and Fixes

Problem: Statement doesn’t arrive in email

Check your spam folder first. Add noreply@safaricom.co.ke to your contacts so future statements don’t get filtered.

Problem: Wrong email address

You can enter a new email address when requesting your M-Pesa statement. Just dial *334# again and submit a new request with the correct email.

Problem: Need transactions from more than a year ago

You can only get the last 12 months online. For older records, you must visit a Safaricom shop. Bring your ID.

Problem: Statement won’t open

Make sure you have a PDF reader on your phone or computer. Most devices come with one, but you can download Adobe Reader for free if needed. You may also need to enter a password. Just enter your ID number when prompted to do so.

Smart Ways to Use Your Statement

Before applying for a loan: Download 6 months of statements. Lenders want to see consistent income and good money habits. Many banks and digital lenders regulated by the Central Bank of Kenya now accept M-Pesa statements as proof of income.

Monthly budget review: Get your statement at the end of each month. See where your money went and plan better for next month.

Business records: If you run a side hustle, your M-Pesa statement works as a basic accounting record. Save one each month. Also, if you have idle cash lying around in your M-Pesa, consider moving it into money market funds where it can earn returns instead of sitting at zero interest.

Dispute resolution: Someone says you didn’t pay? Your statement proves you did. Save it as evidence.

Tax filing: Self-employed? Your M-Pesa transactions count as business records. Keep statements for at least 5 years. The Kenya Revenue Authority accepts M-Pesa statements as proof of business income when filing your returns through their iTax portal.

Also see: Mpesa Calculator

Tips for Better M-Pesa Record Keeping

Set a reminder on your phone to download your statement on the first day of each month. Make it a habit.

Create a folder on your phone or computer labeled “M-Pesa Statements.” Store all PDFs there. You’ll be glad you did so when you need an old one.

Name your files clearly. Use “MPesa_January_2025.pdf” instead of just “statement.pdf.” Makes searching easier.

Back up your statements to Google Drive or another cloud service. Phones get lost or broken.

Review your statement every week for the first month. You’ll quickly learn your spending patterns and catch any weird charges.

When You Need an Official Stamped Statement

M-Pesa statements come with digital stamps that users can download directly to their phone or receive via email, making the process convenient without visiting a Safaricom shop.

Most banks and lenders accept the PDF statement you get via email or the app. It has an electronic stamp that makes it official.

But some situations need a physical stamped copy:

- Court cases

- Immigration applications

- Some government offices

- Older institutions that don’t accept digital documents

For these, visit a Safaricom shop with your ID.

Your M-Pesa Statement Is More Powerful Than You Think

Most Kenyans use M-Pesa every day but never look at their statements. That’s like driving with your eyes half closed.

Your statement tells you where your money goes, helps you budget better, and proves your financial responsibility when you need it most.

The best part? Getting it takes less time than buying airtime. Dial *334#, pick your dates, enter your email. Done.

Download your statement today. Look through it. See anything surprising? Most people do.

Start tracking your transactions monthly. Your future self will thank you when you need a loan, want to control spending, or just need to prove you paid someone.

Your money moves through M-Pesa. Your statement shows you where it goes. Use it.

Nice